Understand SIP returns using a SIP calculator. See how monthly investments grow with real examples and projections.

Many people start investing with confidence but carry a quiet doubt in the background: is the amount they are putting aside each month actually enough? The habit feels responsible, yet the future value of those small monthly decisions often remains fuzzy. This gap between effort and clarity is where uncertainty grows.

A common misunderstanding is assuming that steady investing automatically guarantees a comfortable outcome. The mind tends to focus on how much is being invested today, not on how that commitment behaves over time. Without seeing the pattern clearly, expectations and reality can drift apart.

This confusion is not about lack of discipline. It is about how human intuition struggles with long-term accumulation. Monthly investments feel repetitive and ordinary, while their long-term impact is anything but.

Understanding the idea without overcomplicating it

When you invest a fixed amount regularly, you are not making one big decision but hundreds of small ones. Each contribution enters the market at a different moment, grows at a different pace, and compounds alongside the rest. Together, they form a layered structure rather than a single lump sum.

What matters is not just the amount you invest, but how long each installment gets to stay invested. Early contributions quietly do most of the heavy lifting, even though they are often the easiest to overlook.

Why most people misjudge their future value

The human brain prefers linear thinking. We instinctively multiply monthly investment by the number of months and assume growth will be proportional. Compounding does not work that way, which is why expectations are often either too optimistic or too conservative.

This is where most people get surprised. The same monthly amount can lead to very different outcomes depending on duration and return assumptions, even when nothing dramatic changes on the surface.

Why this calculation matters for real decisions

Investment planning is rarely isolated. It affects how much risk someone is willing to take, whether a goal feels achievable, or when a financial milestone might realistically arrive. Without a clear estimate, decisions are guided more by hope than structure.

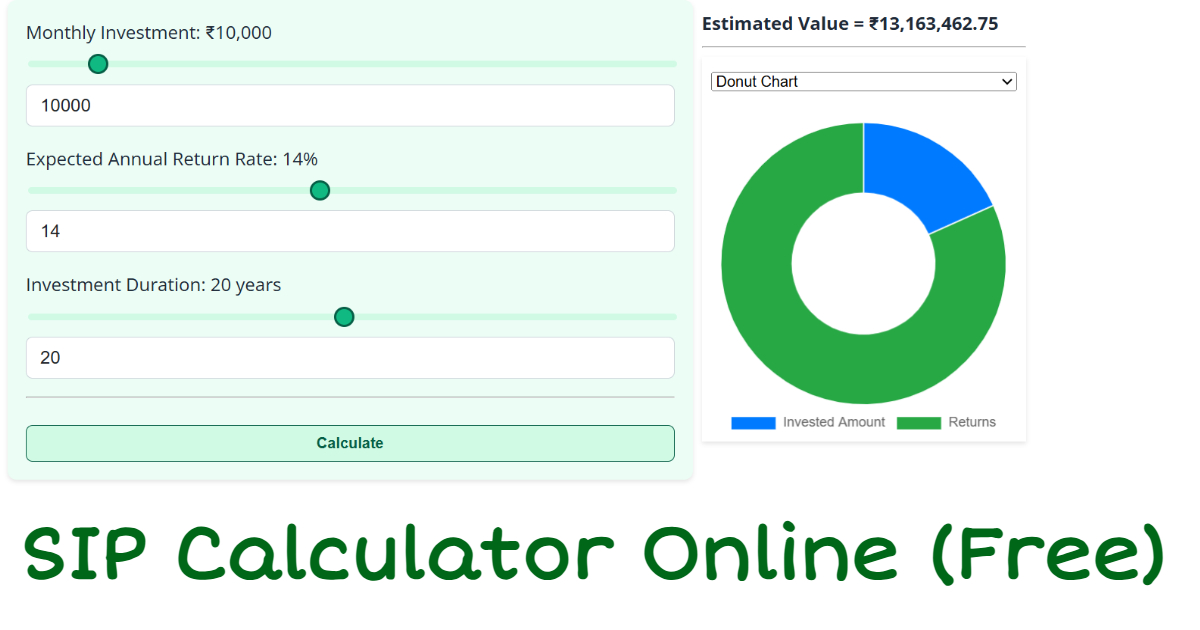

Using a practical estimation tool, such as the SIP calculator available at SIP Calculator Link, helps convert vague assumptions into visible ranges. It does not promise outcomes, but it brings structure to thinking.

The quiet power of time and consistency

Time is the most underestimated variable in long-term investing. A small change in duration often has a larger impact than a noticeable change in monthly contribution. Consistency allows compounding to work uninterrupted, which is where momentum builds.

When you calculate it, the pattern becomes clearer. Short-term fluctuations matter less than staying invested long enough for growth to layer upon itself.

A realistic investing scenario

Consider someone who starts investing after their income stabilizes. The monthly amount feels manageable, not aggressive. In the early years, the balance grows slowly and almost feels disappointing. This phase tests patience more than strategy.

Over time, however, the growth curve begins to bend. Numbers often reveal what assumptions hide, especially when projected across longer periods using a SIP calculation approach.

Common mistakes that distort expectations

- Focusing only on monthly contribution and ignoring investment duration

- Assuming returns will behave smoothly every year

- Stopping or pausing investments too frequently during uncertainty

- Comparing outcomes with others without understanding context

These mistakes are rarely intentional. They usually come from relying on intuition instead of structured estimation.

How this differs from related investment tools

Some tools focus on lump-sum growth, while others estimate required returns. A monthly investment projection is different because it reflects real behavior, not ideal conditions. It mirrors how most people actually invest.

This distinction matters. Regular investing smooths timing risk but makes patience and continuity far more important.

Using the calculator as a clarity tool

The calculator works best when used as an exploration aid rather than a prediction machine. Adjusting time horizons, contribution levels, or assumed returns helps surface patterns that are otherwise hard to visualize.

Small changes often lead to insights that static assumptions cannot provide. This is where understanding deepens and expectations stabilize.

The psychological side of monthly investing

Regular investing reduces decision fatigue, but it can also hide progress. Because changes are gradual, motivation sometimes fades. Seeing projected outcomes reconnects discipline with long-term purpose.

Clarity builds confidence. When expectations are realistic and grounded, staying invested becomes easier during uncertain phases. Exploring different scenarios with a SIP calculator supports patience, perspective, and better long-term decision-making.

Related Articles

View allTrending Articles

- Compound Interest Calculator Explained: How Your Money Grows Over Time

- How to Split Loan EMI Between Co-Borrowers: Calculator & Examples

- Ring Fence Calculator Explained: How to Protect Your Financial Goals

- CAGR Calculator Guide: Measure Real Investment Growth Accurately

- SIP Calculator Guide: How Much Will Your Monthly Investment Be Worth?

- EMI Calculator Explained: How to Calculate Loan EMIs Before Applying