Understand ring fencing in personal finance and use a ring fence calculator to allocate and protect money for specific goals.

Many people save with clear intentions, yet find their money slowly drifting toward unplanned expenses. What was meant for a future goal often gets mixed with day-to-day spending, not out of carelessness, but convenience.

A common assumption is that discipline alone is enough to protect savings. If intentions are strong, funds should remain untouched. In reality, without structure, priorities blur and short-term needs quietly override long-term plans.

This mental gap between intention and execution is where financial goals often lose their clarity.

Understanding the idea without technical framing

Protecting money for a specific purpose is less about restriction and more about separation. When funds are mentally and structurally set aside, decisions around them change.

Ring fencing works by creating clear boundaries. Money meant for a goal is treated differently from general savings, even though it remains part of the same overall financial picture.

Why this approach is often misunderstood

Many people believe separation requires multiple accounts or complex arrangements. Others assume it reduces flexibility.

This is where most people get surprised. Ring fencing is primarily about clarity, not complexity. It helps prioritize without locking money away unnecessarily.

Why this calculation matters for real decisions

Financial choices are rarely isolated. A new expense, a temporary income change, or an unexpected opportunity can all test commitment to a goal.

When allocations are clearly defined, decisions become calmer. Calculating how much is protected versus flexible reveals trade-offs that are otherwise invisible.

The impact of time and small adjustments

Over time, even minor reallocations can weaken protection if they go unnoticed. What starts as a temporary adjustment can become a habit.

When you calculate it, the pattern becomes clearer. Consistency in protection often matters more than the exact amount being set aside.

A practical planning situation

Consider someone managing multiple goals alongside regular expenses. Without clear boundaries, all money feels equally available.

Separating goal-specific funds changes behavior. Numbers often reveal what assumptions hide when each purpose is viewed independently.

Common mistakes that reduce protection

- Keeping all savings in one undifferentiated pool

- Regularly dipping into goal-specific funds for convenience

- Not revisiting allocations as circumstances change

- Overprotecting funds meant to remain flexible

These issues usually arise from lack of visibility rather than lack of intent.

How this differs from related planning tools

Budgeting tools focus on monthly flow. Investment tools focus on growth. Ring fencing focuses on purpose.

This makes it complementary rather than competitive. It brings structure to intention, not just numbers.

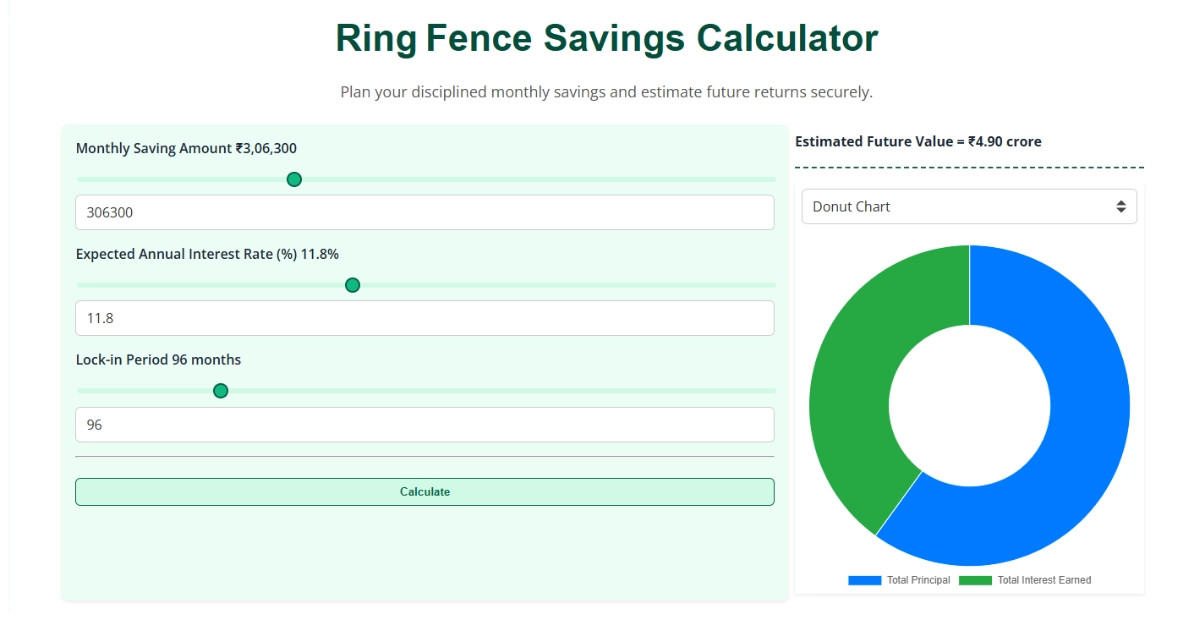

Using the calculator for clarity

The calculator works best as a reflection tool. Adjusting allocations helps visualize how much is truly protected and how much remains adaptable.

Exploration sharpens judgment. Instead of guessing whether goals are safe, clarity emerges through structured allocation.

The psychological side of protecting goals

Clear boundaries reduce internal conflict. When money has a defined role, decisions feel less emotionally charged.

Confidence grows from knowing priorities are protected. Trying different scenarios with the calculator supports patience, reinforces long-term thinking, and leads to financial decisions that feel deliberate rather than reactive.

Related Articles

View allTrending Articles

- Compound Interest Calculator Explained: How Your Money Grows Over Time

- How to Split Loan EMI Between Co-Borrowers: Calculator & Examples

- Ring Fence Calculator Explained: How to Protect Your Financial Goals

- CAGR Calculator Guide: Measure Real Investment Growth Accurately

- SIP Calculator Guide: How Much Will Your Monthly Investment Be Worth?

- EMI Calculator Explained: How to Calculate Loan EMIs Before Applying