Use an EMI calculator to estimate monthly loan payments and understand interest, tenure, and total repayment clearly.

Taking a loan often feels straightforward at first. A bank mentions a monthly amount, paperwork moves quickly, and attention shifts to approval rather than affordability. The real tension usually appears later, when that monthly commitment has to coexist with everyday expenses.

Many borrowers assume that if the installment fits their current income, it will remain comfortable throughout the loan period. What gets missed is how interest, tenure, and small changes quietly reshape the burden over time.

This gap between what sounds manageable today and what actually feels manageable month after month is where confusion begins.

Understanding the idea without technical complexity

A loan repayment is not just about paying back what you borrowed. Each installment is a mix of repayment and cost of borrowing, and that mix changes over time. Early payments feel heavier because interest plays a larger role, even though the total amount paid looks consistent.

Thinking of installments as a dynamic structure rather than a fixed bill helps explain why long-term loans behave differently from short-term ones.

Why this calculation is often misunderstood

Most people focus on the monthly figure quoted during discussions and ignore how it was arrived at. The calculation itself feels abstract, so it is treated as a black box handled by lenders.

This is where most people get surprised. Two loans with similar monthly amounts can have very different total repayment outcomes, depending on interest rate and duration.

Why this clarity matters before committing

A loan decision influences cash flow, savings ability, and even lifestyle choices. Without understanding how the installment behaves across the loan term, trade-offs are made blindly.

When you calculate it yourself, assumptions become visible. It becomes easier to judge whether a slightly higher installment now could mean significantly lower overall cost later.

The role of time and small adjustments

Loan tenure quietly amplifies outcomes. Extending duration reduces monthly pressure but increases long-term cost. Shortening it does the opposite. Even small changes in interest rate or tenure can shift the balance noticeably.

When you calculate it, the pattern becomes clearer. Time is not neutral; it actively shapes how expensive or efficient a loan becomes.

A practical borrowing scenario

Imagine someone comparing two loan options offered at the same time. One feels easier because the monthly amount is lower, leaving more room for other expenses. The other feels tighter but promises quicker closure.

Looking beyond the surface, the long-term difference becomes more apparent. Numbers often reveal what assumptions hide, especially when spread across many months.

Common mistakes that distort decisions

- Judging affordability only by current income

- Ignoring how tenure affects total repayment

- Assuming interest impact is uniform across the loan

- Not testing alternative scenarios before finalizing

These mistakes usually stem from speed, not carelessness. The pressure to finalize often overrides the need to explore.

How this differs from related financial tools

Some tools focus on how much you can borrow, while others estimate future value of investments. An installment projection tool is different because it centers on monthly obligation and cash flow reality.

This perspective is crucial. Borrowing is less about maximum eligibility and more about sustained comfort.

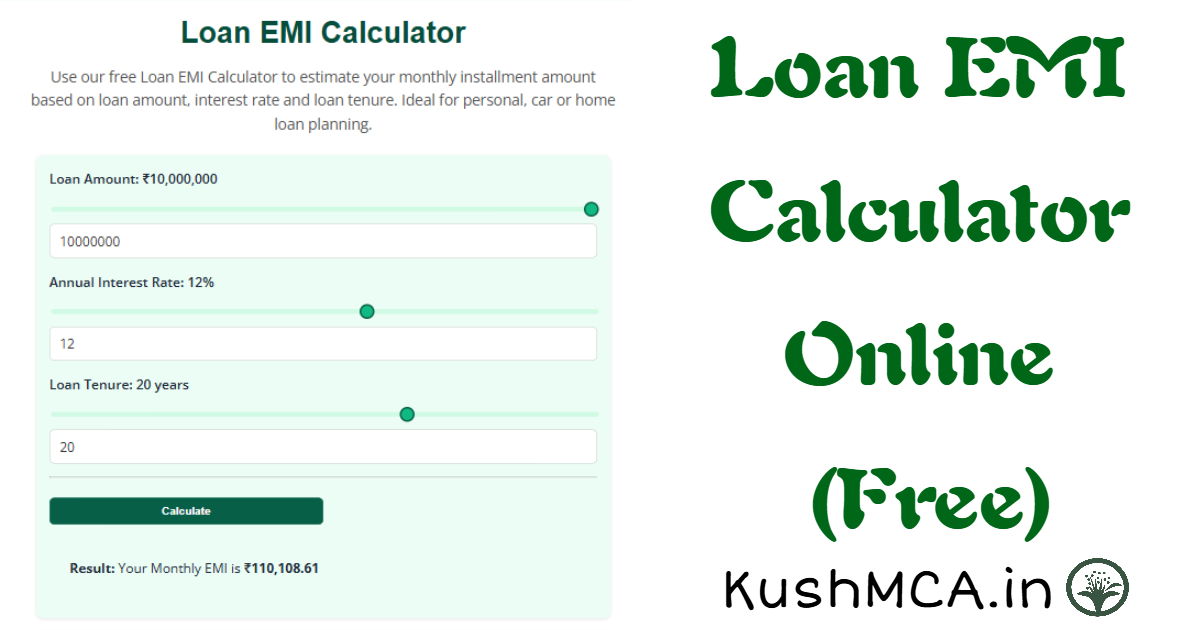

Using the calculator for better perspective

The calculator works best when used to compare possibilities rather than confirm a single option. Adjusting tenure, interest assumptions, or loan amount helps surface trade-offs that are otherwise easy to miss.

Exploration builds confidence. Instead of relying on lender explanations, clarity comes from seeing the structure yourself.

The psychological side of monthly repayments

Fixed installments create a sense of predictability, but they can also mask long-term cost. Because the amount feels stable, the mind stops questioning it.

Clarity restores control. Understanding how installments behave over time supports calmer decisions, realistic planning, and patience. Trying different scenarios using the calculator reinforces long-term thinking and leads to choices that feel sustainable, not just acceptable today.

Related Articles

View allTrending Articles

- Compound Interest Calculator Explained: How Your Money Grows Over Time

- How to Split Loan EMI Between Co-Borrowers: Calculator & Examples

- Ring Fence Calculator Explained: How to Protect Your Financial Goals

- CAGR Calculator Guide: Measure Real Investment Growth Accurately

- SIP Calculator Guide: How Much Will Your Monthly Investment Be Worth?

- EMI Calculator Explained: How to Calculate Loan EMIs Before Applying